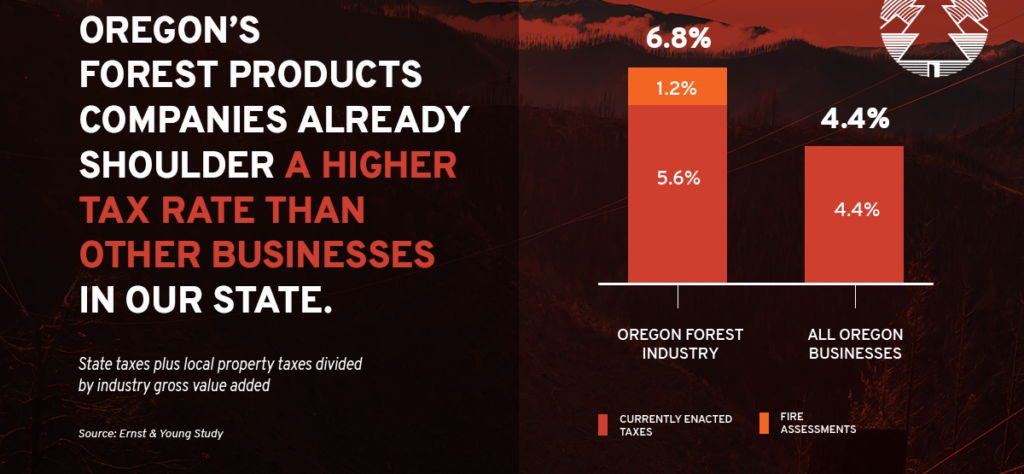

[SALEM, April 13, 2021] – The Oregon Forest & Industries Council today released a groundbreaking report from national accounting firm Ernst & Young detailing the total tax burden on the private forest sector in Oregon. Presented to the Government Issues Committee of the Springfield Area Chamber of Commerce this morning, the report’s primary finding concludes the Oregon forest sector pays more than one-and-a-half times more on average than other Oregon businesses.

“By looking at a variety of publicly available tax and economic data sources for fiscal year 2019, we concluded the tax burden on Oregon’s forest industry is greater than other Oregon industries, including the agriculture and manufacturing sectors, and is one-and-a-half times greater than the overall total Oregon business tax burden,” said Caroline Sallee, project lead on the report and Senior Manager with Ernst & Young LLP’s Quantitative Economics and Statistics Group.

Ernst & Young’s report is the first time a comprehensive analysis has looked at the aggregate forest industry tax burden and comes at a time when the Oregon Legislature is considering legislation that would further increase taxes on the sector.

“Our intuition told us this had to be the worst possible time to further increase taxes on businesses, and on the forest sector in particular,” said Todd Payne, Chairman of the Oregon Forest & Industries Council’s Board of Directors and Chief Executive Officer for Seneca Family of Companies. “We’ve just suffered the worst wildfire season in history – private forestland owners lost over 400,000 acres in the Labor Day fires and we are actively working to restore and replant those lands at significant costs. Many of our rural communities are suffering multiple extreme hardships as they struggle to rebuild post-fire while the global pandemic and business shutdowns are taking enormous tolls. This report unequivocally concludes our sector already pays more than its fair share in taxes and it vindicated our sense that additional tax increases are motivated more by philosophical differences about forest management than they are by any sense of tax equity.”

The report calculated the total tax burden by aggregating all taxes paid by the sector, including property taxes, income taxes, small tract forestland taxes, corporate income and excise taxes, fire assessments and privilege taxes. All told, in 2019 the forest sector contributed over $142 million to state tax coffers.

“Given the report’s findings, we now know that legislation under consideration in the 2021 legislative session would effectively double the total taxes currently paid by the forest sector,” said Adrian Miller, Chair of the Oregon Forest & Industries Council’s Tax Committee and Director of Public Affairs for Rayonier. “That would increase the forest sector’s effective aggregate tax rate to nearly three times more than other Oregon businesses pay. At a time when the latest state revenue forecast indicates the Legislature has nearly $800 million more to work with this session than it originally thought and has billions of dollars in reserves, doubling the tax burden on the forest sector seems unnecessary.”

As the number one softwood lumber and plywood producer in the nation, Oregon’s forest sector is one of the state’s cornerstone industries and serves as the economic backbone for many rural counties. Lane County, where the report was unveiled, combined with neighboring Douglas county are often considered the wood basket of the United States as the two counties together encompass over a quarter of the state’s annual timber harvest. Over 80 percent of this timber is harvested from privately owned forestlands.

“When the Chamber was first made aware of this study, we were thrilled at the opportunity to bring the project lead in front of our Government Issues Committee,” said Vonnie Mikkelsen, President and CEO of the Springfield Area Chamber of Commerce. “In Lane County alone, the forest sector provides over 7,000 jobs that pay, on average, 130 percent of the county annual wage. Eighty-five percent of Lane county is forested, and we are home to nearly 30 primary wood products manufacturing facilities. This study is the first time we’ve seen information like this put together and underscores that the health of the forest sector has a direct bearing on our local economies.”

Ernst & Young was commissioned by the Oregon Forest & Industries Council to complete the report at the end of 2020, after reviewing prior work done by the firm. Oregon Business and Industry commissioned Ernst & Young in 2020 to quantify the impact of recently enacted state tax programs on the total tax burden borne by Oregon businesses. That report concluded in the past few years, the Oregon Legislature has increased the tax burden on businesses by 41 percent.

“We never before had reason to commission an exercise like this until we saw legislation introduced that attempted to change the forest tax program in Oregon,” said Miller. “We felt to have a reasonable conversation about that we needed to first establish a baseline for what the sector currently contributes to state taxes. We selected Ernst & Young from among several leading regional and national economics firms largely because of the experience they – and Ms. Sallee, in particular – had in analyzing the impact of diverse state and local taxation programs on businesses, both in Oregon and across the United States.”

To view a recording of the full presentation to the Springfield Area Chamber of Commerce, please click here. To view the full Ernst & Young report, please click here.

###

The Oregon Forest & Industries Council is a trade association representing more than 50 Oregon forestland owners and forest products manufacturers. OFIC’s members combine sustainable forest management practices with the latest science and technology to continuously improve the environmental, social and economic value of healthy working forests. We protect and manage more than 5 million acres of Oregon forestlands, employ nearly 60,000 Oregonians, and make Oregon the nation’s largest state producer of softwood and plywood. For more information, go to ofic.com.

Contact: Sara Duncan

Phone: 503-828-2373

Email: sara@ofic.com