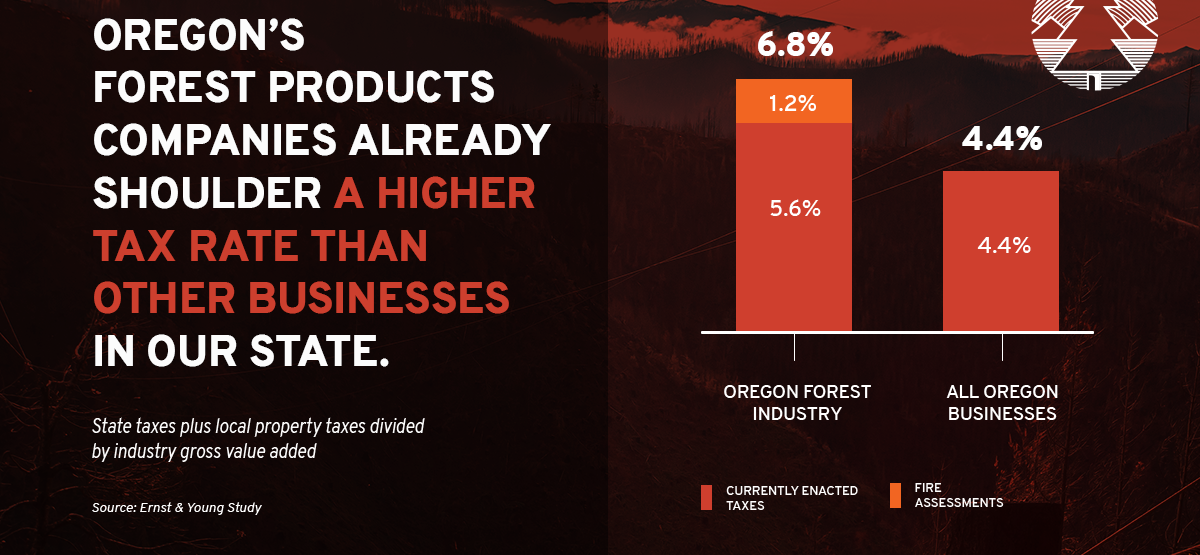

The timber industry already pays a higher tax burden than other businesses in Oregon

A recent independent analysis done by nationally recognized economics and accounting firm Ernst & Young concluded that as a function of gross value added (i.e. output minus costs), the forest products sector pays an aggregate tax rate that is, on average:

- 1.5 times more than other Oregon business sectors

- 2 times more than the manufacturing sector

- Over 1.25 times more than the agriculture sector

- 3 times more for fire protection than Washington landowners

Keeping forests as forests is in the best interest of all Oregonians

While timber is more than just a crop – forests provide a host of social and environmental benefits other crops do not – it is taxed just like every other crop in Oregon. As is the case with hazelnuts, when trees are harvested, processed, and sold, income is generated and taxed. Up-front costs (planting, thinning, pest and fire prevention) aren’t recouped for 40 years or more, provided trees aren’t destroyed by mother nature before then.

Similarly, forest landowners are taxed just like all other landowners in Oregon. Forestland is taxed at its real market value: as land primarily used to grown and harvest timber, just like agriculture land is taxed as its use for growing crops and residential and commercial property is taxed accordingly.

Thanks to state policy that prioritizes maintaining forestland, Oregon has the same amount of forestland now as we did 100 years ago.

Reinstating a severance tax encourages conversion of forestland to other uses (residential, industrial, agricultural) that do not provide environmental benefits like carbon capture and storage, wildlife habitat, clean water, and recreation.

Severance taxes are for “severed resources” like coal and crude oil, not a crop that is planted and cultivated over time. State law requires harvested timber be replanted – on average four trees are planted for every one that is harvested.

Related posts:

Study Finds Tax Burden Greater on Forest Sector Than on Other Oregon Businesses

[SALEM, April 13, 2021] – The Oregon Forest & Industries Council today released a groundbreaking report from national accounting firm Ernst & Young detailing the total tax burden on the private forest sector in Oregon. Presented to the Government Issues Committee of the Springfield Area Chamber of Commerce this morning, the report’s primary finding concludes […]

Opinion: Tax policy should respect stability of Oregon logging businesses

By: Todd Payne | The Oregonian | March 10, 2021 Payne is chief executive of Seneca Family of Companies and chairman of the board for the Oregon Forest and Industries Council. **This opinion originally appeared in The Oregonian. The March 2 story “Oregon’s logging industry says it can’t afford new taxes” misunderstands the market complexities […]

Opinion: Timber, environmental interests’ collaborative problem-solving deserves Oregonians’ support

By: Arnie Roblan and Caddy McKeown | The Oregonian | Feb. 7, 2021 Roblan, a Democrat from Coos Bay, represented District 5 in the Oregon Senate from 2013 until last month. McKeown, a Democrat from Coos Bay, represented District 9 in the Oregon House from 2013 until last month. This opinion originally appeared in The […]